Crypto Moving Average Trading Strategy #5: Whipsaws Crypto Moving Average Trading Strategy #4: Support and Resistance Crypto Moving Average Trading Strategy #3: Crossovers Crypto Moving Average Trading Strategy #2: Combining MA’s Crypto Moving Average Trading Strategy #1: Trend

#50 AND 200 EMA STRATEGY HOW TO#

How to Trade Based on Moving Averages? MA, SMA, EMA, WMA Crypto Trading Strategies Best Moving Average Settings for Crypto Trading When used correctly, these EMA settings can provide signals for profitable trades. However, the 5 and 13 EMA combination, 50 and 200 EMA combination, and 21 and 55 EMA combination are the most popular EMA settings used with RSI. Traders can experiment with different EMA settings to identify which one works best for them. The best EMA setting to use depends on the trader’s trading strategy and time frame.

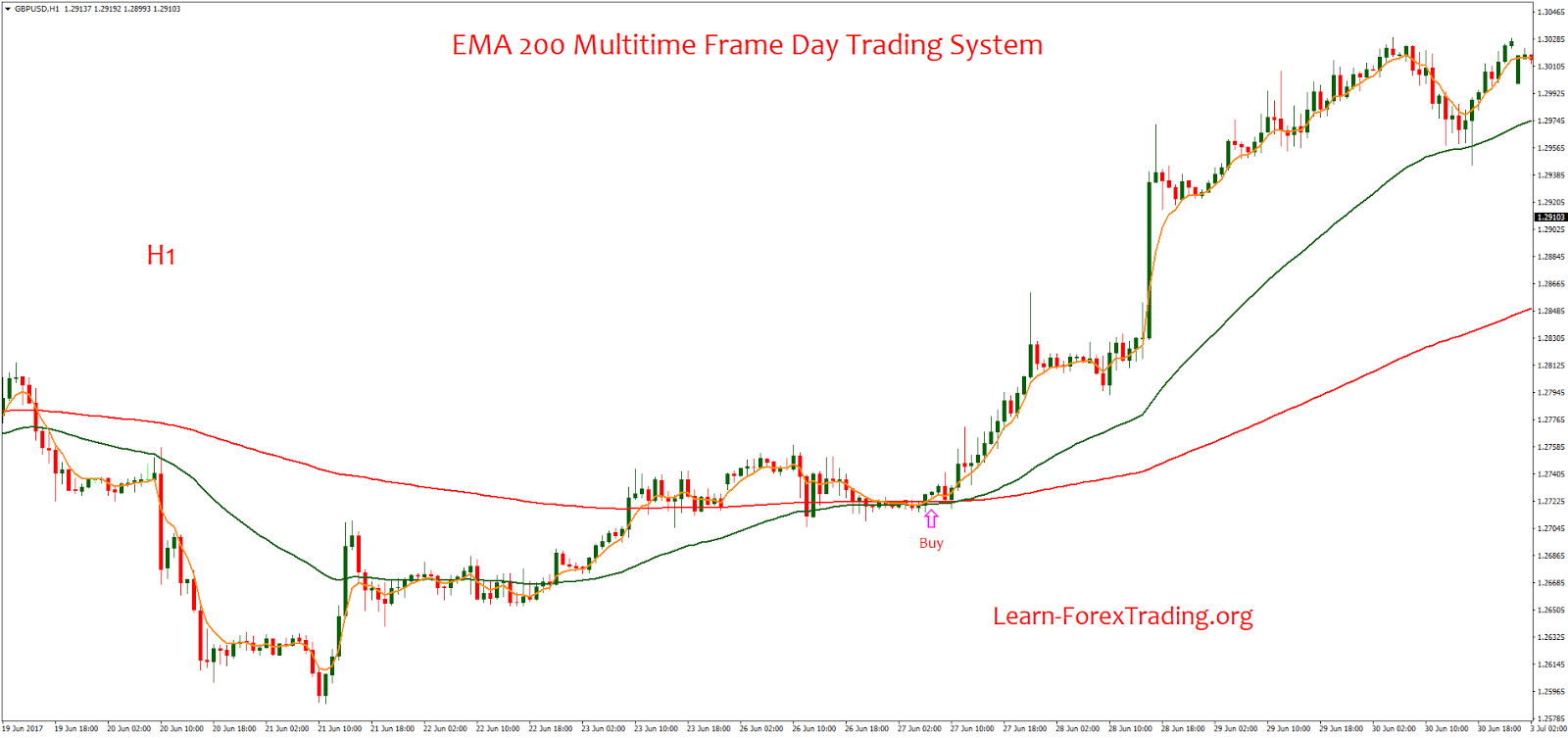

In conclusion, there are various EMA settings that traders can use with RSI in forex trading. On the other hand, if the 21 EMA crosses below the 55 EMA, and the RSI is below 50, it indicates a strong bearish trend. For example, if the 21 EMA crosses above the 55 EMA, and the RSI is above 50, it indicates a strong bullish trend. Traders can use the RSI to confirm the trend identified by the 21 and 55 EMA combination. When the 21 EMA crosses above the 55 EMA, it indicates a bullish trend, and when the 21 EMA crosses below the 55 EMA, it indicates a bearish trend. The 21 EMA is the faster moving average, and the 55 EMA is the slower moving average. This setting is used to identify medium-term trends and provides signals for entry and exit points. The 21 and 55 EMA combination is another popular EMA setting to use with RSI. On the other hand, if the 50 EMA crosses below the 200 EMA, and the RSI is below 50, it indicates a strong bearish trend. For example, if the 50 EMA crosses above the 200 EMA, and the RSI is above 50, it indicates a strong bullish trend. Traders can use the RSI to confirm the trend identified by the 50 and 200 EMA combination. When the 50 EMA crosses above the 200 EMA, it indicates a bullish trend, and when the 50 EMA crosses below the 200 EMA, it indicates a bearish trend. The 50 EMA is the faster moving average, and the 200 EMA is the slower moving average. This setting is used to identify long-term trends and provides signals for entry and exit points. On the other hand, if the 5 EMA crosses below the 13 EMA, and the RSI is below 50, it indicates a strong bearish trend.Īnother popular EMA setting to use with RSI is the 50 and 200 EMA combination. For example, if the 5 EMA crosses above the 13 EMA, and the RSI is above 50, it indicates a strong bullish trend. Traders can use the RSI to confirm the trend identified by the 5 and 13 EMA combination. When the 5 EMA crosses above the 13 EMA, it indicates a bullish trend, and when the 5 EMA crosses below the 13 EMA, it indicates a bearish trend. The 5 EMA is the faster moving average and the 13 EMA is the slower moving average. This setting is used to identify short-term trends and provides signals for entry and exit points. One of the most popular EMA settings to use with RSI is the 5 and 13 EMA combination. Now, let’s look at which EMA settings are best to use with RSI in forex trading. EMAs are used to identify trends and provide signals for entry and exit points. This means that the EMA reacts more quickly to price changes than a simple moving average. When the RSI is above 70, it indicates that the asset is overbought, and when it is below 30, it indicates that the asset is oversold.ĮMAs are a type of moving average that gives more weight to recent price data than older data. The RSI oscillates between 0 and 100 and is used to identify overbought or oversold conditions in the market. The RSI is a technical indicator that measures the strength of a financial instrument’s price action. Before we dive into the best EMA settings, let’s take a brief look at RSI and EMAs.

0 kommentar(er)

0 kommentar(er)